The Beginner's Guide to Measuring (and Improving) Customer Success Metrics

Are you unsure if your customers are truly satisfied with your products or services? Don't let unhappy customers slip through the cracks. This article reveals the essential metrics that give you a clear picture of how well you're meeting your customers' needs and keeping them loyal.

Summary:

- Why Customer Success Metrics Are Your Secret Weapon

- The Benefits of Customer Success Metrics

- The Top 10 Customer Success Metrics

- #1 - Customer Health Score

- #2 - Net Promoter Score (NPS)

- #3 - Customer Churn Rate

- #4 - Customer Retention Cost (CRC)

- #5 - Customer Lifetime Value (CLV)

- #6 - Monthly Recurring Revenue (MRR)

- #7 - Customer Satisfaction (CSAT) Score

- #8 - Customer Effort Score (CES)

- #9 - Renewal Rate

- #10 - Product Adoption Rate

- Your Action Plan for Customer Success

- Which Metrics Should I Be Tracking?

- How Often Should I Check My Metrics?

- Can I Improve Customer Success Without Hiring a Whole New Team?

- What’s the Difference Between Customer Success and Customer Service Metrics?

- How Do I Know if My Customer Success Strategy Is Working?

- How Does a Customer Success Team Impact Customer Success Metrics?

Want to turn happy customers into raving fans?

The secret is understanding and measuring customer success.

Customer success is a proven strategy for boosting your bottom line, providing with you with valuable information to help you improve every aspect of your business, from the product or service itself, to support team quality, and optimizing your overall customer journey, for both existing and upcoming customers.

So, whether you're a seasoned marketer, a business owner, or just someone who wants to understand what makes customers tick, this guide is your treasure map to unlock the power of customer success metrics.

We'll break down the essentials:

- What customer success is (and why it's more than just a buzzword)

- Why measuring it matters (hint: it's not just for bragging rights)

- How to track the key metrics that'll reveal what your customers really think and feel

Forget those vague notions of customer satisfaction. We're talking about concrete insights that can transform your business.

Are you ready to dive in? Let's get this party started! 🎉

Why Customer Success Metrics Are Your Secret Weapon

Customer success KPIs are like having a crystal ball that reveals what your customers really think and feel.

The thing is, so many businesses think they know what their customers want, but this is guesswork. When you use actual metrics, you no longer have to come up with strategies and hope for the best (which are usually wrong), but you have tangible data to make real decisions that address real problems and, therefore, get real results.

Think of customer success metrics as your marketing X-ray vision, revealing:

- The good: What’s working, what’s making your customers happy, and what you should keep doing more of.

- The bad: What’s causing friction, frustration, or making customers consider jumping ship.

- The ugly: Those hidden pain points you might not even be aware of.

By measuring these key indicators, you’re not just collecting data; you’re gaining a deeper insights. Long story short, if you’re not tracking customer success efforts and metrics, you’re flying blind.

The Benefits of Customer Success Metrics

The TLDR of this is that your custom service metrics give you real-life data to work with to make real, actionable decisions.

But for a little more detail, here’s why these metrics, like your customer satisfaction score and the sorts, are worth their weight in gold:

- Make decisions like a boss: You’ll have hard data to back up your choices, giving you the confidence to make strategic moves that deliver results.

- Create customer experiences that wow: When you truly understand your customers, you can personalize every interaction. That’s the kind of service that turns customers into raving fans.

- Invest wisely, reap the rewards: Stop wasting resources on strategies that don’t work. Measuring customer success shows you where to focus your efforts for maximum impact.

But wait, there’s more! Tracking customer success metrics has some seriously awesome side effects:

- Happier customers = loyal customers: When you go above and beyond to meet their needs, customers are more likely to stick around.

- Word-of-mouth magic: Satisfied customers become your biggest cheerleaders, spreading the word about your brand like wildfire. That’s free advertising you can’t buy!

- More money, honey: Let’s be honest, who doesn’t want that? Increased customer lifetime value, reduced acquisition costs, and scalable growth are just a few of the delicious financial benefits you can expect.

It’s time to stop guessing and start measuring. Your customers – and your bank account – will thank you!

The Top 10 Customer Success Metrics

#1 - Customer Health Score

Imagine having a magic dashboard that tells you exactly how healthy your customer relationships are. That's essentially what your Customer Health Score (CHS) does.

Think of it like a Fitbit for your customers, tracking customer engagement and giving you a real-time snapshot of their overall well-being.

Here's why your CHS is so valuable:

- Spot Trouble Before It Starts: A low CHS is a red flag that a customer might be unhappy or disengaged. By catching these warning signs early, you can swoop in with solutions before they decide to jump ship.

- Keep Customers Happy and Engaged: Regularly monitoring your CHS allows you to stay one step ahead, proactively addressing any issues and keeping your customers satisfied.

- Predict Growth Opportunities: A high CHS is like a beacon of potential. These customers are your biggest fans, most likely to make repeat purchases, upgrade to premium services, or sing your praises to their friends.

So, How Do You Calculate This Magical Score?

The exact formula will vary depending on your business, but here's the general idea:

- Identify Key Indicators: What factors are most important to your customers' success? Think product usage, support interactions, survey responses, etc.

- Assign Weights: Some factors are more important than others. Give each one a weight that reflects its impact on customer health.

- Collect Data: Gather the data for each customer across all your indicators.

- Calculate the Score: Apply the weights to the data, and voila! You have a personalized CHS for each customer.

Pro Tip: Your CHS isn't a one-and-done thing. Keep refining it over time as your business and customer needs evolve.

Boosting Your Customer Health Score

Think of it like a workout routine for your customer relationships. Here are a few exercises to get you started:

- Engagement Boost: Offer educational content, webinars, or exclusive perks to keep customers engaged and excited about your brand.

- Personal Touch: Show your customers you care with personalized messages, check-ins, and tailored recommendations.

- Support Squad: Make sure your customer support team is top-notch. Resolve issues quickly and efficiently to keep those smiles wide.

Remember, a healthy customer base is a happy customer base. And happy customers are the key to a thriving business. So, start tracking your CHS today and watch your customer relationships – and your bottom line – flourish!

#2 - Net Promoter Score (NPS): The Ultimate Customer Loyalty Barometer

Want to know if your customers are raving fans or ticking time bombs? The Net Promoter Score (NPS) is your answer.

It's a simple question with a powerful punch: "On a scale of 0 to 10, how likely are you to recommend us to a friend or colleague?"

Here's why NPS is the rockstar of customer success metrics:

- Measures Loyalty Over Time: It's not just a one-time snapshot; it's a continuous gauge of how your customers feel about you.

- Easy Peasy Customer Feedback: One question is all it takes. No complicated surveys or lengthy questionnaires. Just a quick and easy way for customers to tell you what they really think.

- Benchmark Your Awesomeness: Compare your NPS with industry averages and see how you stack up against the competition

How to Crack the NPS Code

Ask the Question: Survey your customers and gather their responses.

Sort Them into Groups:

- Promoters (9-10): Your ride-or-die fans. They love you and want everyone to know it.

- Passives (7-8): They're satisfied but not overly enthusiastic. They could be tempted by shiny new competitors.

- Detractors (0-6): The unhappy campers. They're not afraid to share their negative experiences.

Calculate Your Score: Subtract the percentage of Detractors from the percentage of Promoters. The higher the score, the better!

Read also: What Net Promoter Score is Considered Good?

What Your NPS Score Really Means

- Positive NPS (>0): You're doing something right! You have more Promoters than Detractors.

- High NPS (50+): You're killing it! Your customers are loyal and passionate about your brand.

- Negative NPS (<0): Time for some serious soul-searching. You've got some unhappy customers who need your attention.

How to Boost Your NPS Like a Boss

Don't ignore the haters. Reach out to them, address their concerns, and try to turn that frown upside down.

Show them some extra love with personalized offers, exclusive content, or sneak peeks at new products.

Give your biggest fans the tools to spread the word. Make it easy for them to share their positive experiences on social media or leave glowing reviews.

#3 - Customer Churn Rate: The Leaky Bucket You Need to Plug

Imagine your business as a bucket full of valuable customers. Now imagine those customers slowly dripping out through a tiny hole. That's customer churn rate and a silent killer for your bottom line.

But don't despair! Understanding and tackling churn is the key to plugging those leaks and keeping your bucket overflowing.

Here's the deal:

- Churn is a Red Flag: A high churn rate is like a smoke alarm going off. It signals that something's not quite right with your customer satisfaction, product usability, or perceived value.

- Financial Fallout: Every customer you lose means less recurring revenue. That leaky bucket adds up fast and can seriously impact your profitability.

- Hidden Clues: By analyzing churn, you'll gain valuable insights into why customers leave. This intel is crucial for identifying areas where you can improve and make your business even better.

How to Calculate Your Churn Rate

- Pick Your Timeframe: Month? Quarter? Year? It's up to you, but be consistent.

- Count the Losses: How many customers canceled or didn't renew during that time?

- Do the Math: Divide the number of churned customers by the total number you started with, then multiply by 100 to get your percentage.

Example: If you started the month with 100 customers and lost 10, your churn rate is 10%. Ouch.

Time to Plug Those Leaks

Reducing churn is all about keeping your customers happy and engaged. Here are some proven strategies to get you started:

- Smooth Onboarding: Make sure new customers have a seamless experience from day one. Offer tutorials, guides, and support to set them up for success.

- Stay Connected: Don't ghost your customers. Send regular emails with valuable content, helpful tips, or exclusive offers.

- Get Personal: Tailor your communication to each individual's needs and interests. Show them you're paying attention.

- Embrace Feedback: Ask for it, listen to it, and act on it. This shows you value their opinions and are committed to improving.

- Stellar Support: Be there for your customers when they need you. A positive support experience can turn a frustrated customer into a lifelong fan.

Remember, some churn is inevitable. But by implementing these strategies, you can keep those leaks to a minimum and watch your customer bucket overflow with loyalty and love.

#4 - Customer Retention Cost (CRC): The Price of Loyalty (and How to Make It Worth Every Penny)

Customer retention cost (CRC) is like the price tag of keeping your customers happy and returning for more. It’s the cost of customer service, loyalty programs, targeted marketing, and anything else you do to keep your existing customers loyal.

To calculate customer retention cost, consider the total annual cost of customer success and retention efforts and divide it by the number of active customers. This is different from your customer retention rate.

But here’s the thing: it’s not about pinching pennies; it’s about spending smarter. Understanding your CRC is like having a financial advisor for your customer relationships.

Here’s why it’s so important:

- Maximize Your ROI: You don’t want to overspend on keeping a customer. Knowing your CRC helps you make sure your investment is paying off.

- Spend Wisely: Not all retention strategies are created equal. Your CRC can reveal which ones are giving you the biggest bang for your buck.

- Track Your Success: By comparing your CRC to your customer lifetime value (CLV), you can see if your retention efforts are actually working.

How to Calculate Your CRC in 3 Easy Steps

- Add Up Your Costs: Tally up everything you spend on customer retention.

- Count Your Loyal Customers: How many customers did you successfully keep during that same time period?

- Divide and Conquer: Divide your total retention costs by the number of retained customers, and you’ve got your average CRC per customer.

Example: If you spent $5,000 on retention last quarter and kept 500 customers, your CRC is $10 per customer.

How to Make Your CRC Work Harder for You

Remember, the goal is to get the most out of your retention budget. Here’s how:

- Up Your Customer Experience Game: Invest in your support team, improve your product, and create an experience that makes customers want to stick around.

- Embrace Tech: Use automation and CRM tools to streamline your communication and personalize your outreach without breaking the bank.

- Segment Like a Pro: Not all customers are the same. Tailor your retention efforts to different segments based on their needs and preferences.

- Analyze and Adapt: Regularly review your CRC and make adjustments as needed. This keeps your retention strategies fresh and effective.

By focusing on cost-effective strategies that deliver maximum impact, you can build a loyal customer base that’s not only happy but also profitable.

#5 - Customer Lifetime Value (CLV): Your Compass for Long-Term Profit

Picture this: a crystal ball that predicts the future revenue each customer will bring to your business. That's the power of Customer Lifetime Value (CLV).

Think of it as your business GPS, guiding your strategies and helping you make smarter decisions about where to invest your time and resources.

Why CLV is Your Business BFF

- Forecast the Future: CLV gives you a glimpse into the future, predicting how much revenue each customer will generate over their lifetime. This helps you plan ahead and budget more effectively.

- Invest Wisely: Not all customers are created equal. Some are high rollers, while others are more casual spenders. CLV helps you identify your most valuable customers to prioritize your efforts and maximize your ROI.

- Build for the Long Haul: CLV shifts your focus from short-term wins to long-term relationships. It's about nurturing customers for the long haul and creating a sustainable business that thrives over time.

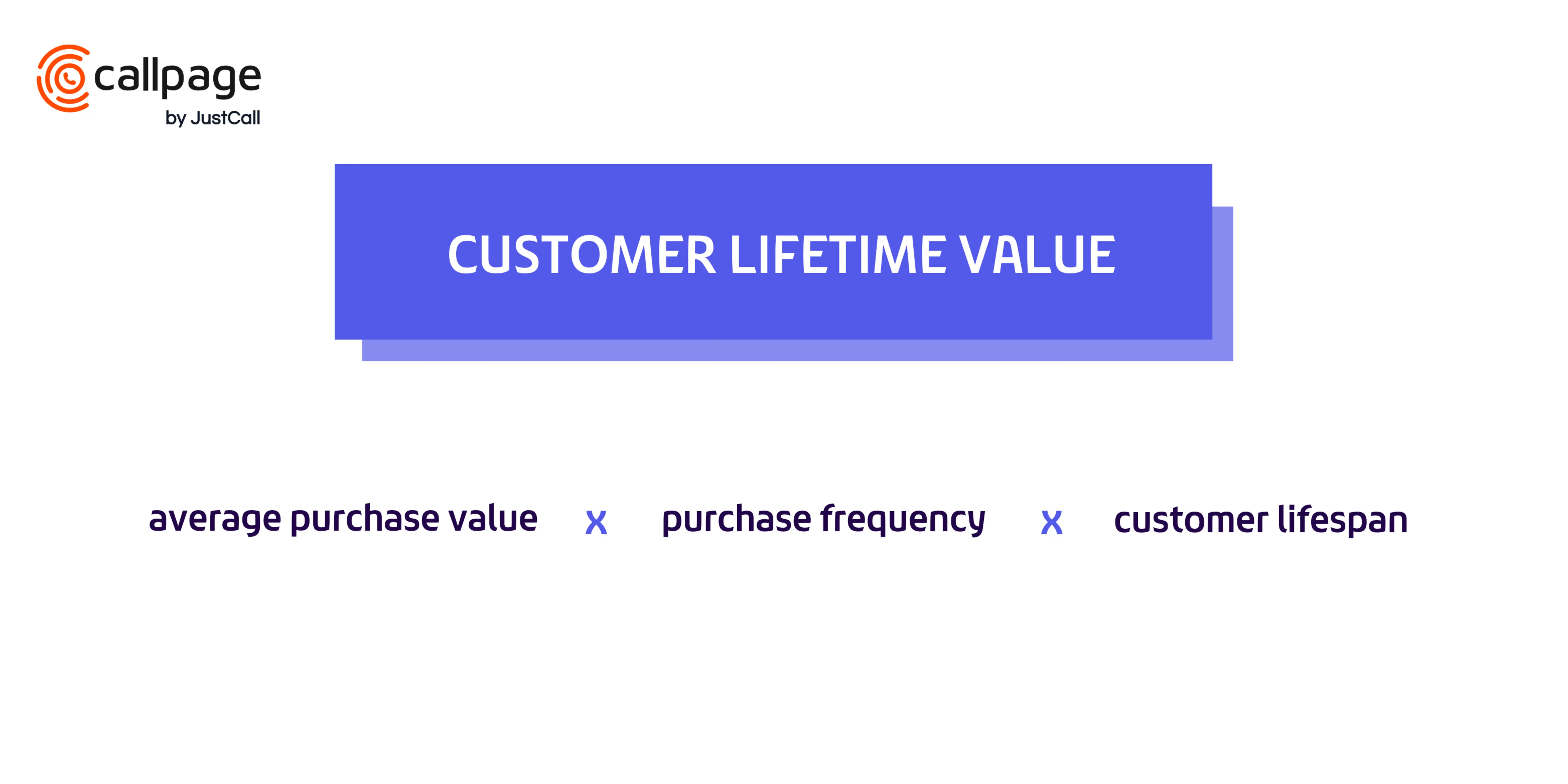

How to Calculate Your CLV

It's easier than you might think! Just use this simple formula:

Example: If your average customer spends $50 per purchase, buys from you twice a year, and stays with you for 5 years, their CLV is $50 x 2 x 5 = $500.

How to Boost Your CLV Like a Boss

Increasing your CLV is like a game of Tetris – it's about fitting all the right pieces together to create a solid foundation for growth.

Here are some winning moves:

- Deliver an Unforgettable Experience: Go above and beyond to exceed expectations. Make your product or service so good they can't imagine life without it.

- Personalize Like a Pro: Tailor your communication and recommendations to each customer's individual needs and preferences. Make them feel like you're reading their mind!

- Reward Loyalty: Create a loyalty program that shows your repeat customers love and exclusive perks. It's a win-win: they feel appreciated, and you get more sales.

- Stay Connected: Don't let the conversation die after the purchase. Keep them engaged with regular updates, valuable content, and special offers.

- Act on Feedback: Listen to your customers and use their feedback to improve your offerings. Show them you care about their opinions and are committed to making their experience even better.

Remember, CLV isn't just about numbers; it's about building lasting customer relationships. Focus on their success, and your business will reap the rewards.

Check out our full guide on CLV, featuring ten effective strategies: Top 10 Strategies to Increase Customer Lifetime Value

#6 - Monthly Recurring Revenue (MRR): Your Financial Crystal Ball

Monthly Recurring Revenue (MRR) is like your financial fortune teller, giving you a glimpse into the future of your business’s bank account.

It’s the lifeblood of subscription-based businesses, representing the predictable income you can expect each month. Think of it as the rhythm of your business’s heartbeat – a steady beat means a healthy and thriving company.

To calculate your monthly recurring revenue, multiply the total number of monthly active customers by the average revenue per user.

Here’s why MRR is the metric you need to watch:

- Predictability: MRR lets you forecast your income with confidence, making budgeting and planning a breeze. No more financial surprises!

- Success Barometer: A healthy MRR means your customers are happy and sticking around. It’s a clear sign that your product or service is delivering value.

- Strategic Compass: MRR data helps you make smarter decisions about where to invest your resources. Should you focus on acquiring new customers or nurturing existing ones? MRR will guide your strategy.

Calculating Your MRR is a Piece of Cake

- Monthly Subscriptions: Add up all the recurring revenue from your active subscribers.

- Prorate for Changes: Adjust for any mid-month sign-ups or cancellations.

- Total It Up: That’s it! You’ve got your MRR.

Example: If 500 customers pay you $20 monthly, your MRR is a cool $10,000.

How to Make Your MRR Sing

Ready to crank up the volume of your recurring revenue? Here’s how:

- Reduce Churn: Keep your existing customers happy and engaged so they stick around for the long haul.

- Upsell and Cross-Sell: Offer your customers additional products, services, or premium features to increase spending.

- Optimize Pricing: Make sure your pricing reflects the value you provide and resonates with your target audience.

- Acquire New Customers: Keep those marketing and sales engines running to attract new subscribers.

- Smooth Onboarding: Create a seamless onboarding experience that sets your customers up for success and reduces early churn.

By focusing on both customer retention and acquisition, you can create a steady stream of recurring revenue that fuels your business growth and helps you achieve your goals. So, start tracking your MRR today, and let it guide you towards a prosperous future!

#7 - Customer Satisfaction (CSAT) Score: Your Happiness Meter for Happy Customers

Think of your Customer Satisfaction (CSAT) score as a happiness meter for your customers. It’s a quick temperature check that tells you how they feel about your products, services, or specific interactions.

The customer satisfaction score (CSAT) involves asking customers to rate their experience with your company, and it is calculated using the percentage of satisfied responses out of the total number of survey responses.

This little metric packs a big punch:

- Instant Feedback Loop: CSAT surveys capture customer sentiment right after an interaction, giving you immediate insights into what’s working and what needs a little TLC.

- Product & Service Checkup: A high CSAT score indicates that your customers love what you offer. A low score? Time to roll up your sleeves and investigate those areas that need improvement.

- Loyalty Booster: While it’s not the only factor, a high CSAT score often leads to more loyal customers returning for more.

How to Take Your Customers’ Temperature

It’s simple:

- Survey Says…: Ask your customers one simple question about their satisfaction, usually after an interaction or purchase. Something like, “How would you rate your experience today?”

- Rate Your Happiness: Give them a scale (1-5, 1-10, etc.) to quantify their feelings.

- Calculate the Average: The percentage of positive responses is your CSAT score.

Example: If 80 out of 100 customers give you a 4 or 5 rating, your CSAT score is 80%. Not too shabby!

How to Turn That Frown Upside Down (and Boost Your CSAT)

- Empower Your Team: Invest in your customer service superstars. Give them the training and tools they need to deliver exceptional service that leaves customers smiling.

- Close the Feedback Loop: Don’t just collect feedback; act on it! Show your customers you’re listening, and you value their input.

- Speedy Resolutions: Solve problems quickly and efficiently. Sometimes, a fast response is just as important as the solution itself.

- Personalize Everything: Make your customers feel special. Tailor your communication, offers, and recommendations to their individual needs.

- Monitor Like a Hawk: Keep an eye on your CSAT score over time to spot trends and identify areas that need attention.

Remember, a happy customer is a loyal customer. By prioritizing satisfaction and continuous improvement, you’ll build a thriving business where customers can’t wait to sing your praises.

#8 - Customer Effort Score (CES): Make it Easy for Customers to Love You

Imagine strolling through an airport where everything is smooth sailing – no lines, no delays, just a seamless journey from check-in to boarding. That's the kind of effortless experience you want to create for your customers.

And that's where the Customer Effort Score (CES) comes in.

Think of it as a friction detector for your customer interactions. It measures how easy (or difficult) it is for your customers to get their issues resolved or complete tasks.

Why CES is Your Golden Ticket to Loyalty

- Smooth Sailing = Happy Customers: Nobody likes jumping through hoops or navigating a labyrinth of phone menus. A low-effort experience is the key to keeping customers happy and loyal.

- Loyalty = $$$: Studies show that customers who have effortless experiences are more likely to stick around and become repeat buyers. It's a simple equation: easy = loyal = profitable.

- Operational Efficiency: CES isn't just about customer happiness. It also helps you identify bottlenecks and inefficiencies in your processes, leading to smoother operations and a happier team.

How to Measure Your CES (It's Easier Than You Think)

- Ask the Question: After a customer interaction, simply ask them to rate how easy it was to get their issue resolved or complete their task. Use a scale of 1 (very difficult) to 5 (very easy).

- Calculate the Average: The higher the score, the smoother the experience for your customers.

Example: If you get 50 responses with an average rating of 4, your CES is 80%. That's a good start, but there's always room for improvement!

How to Make Your Customer Experience Even More Effortless

- Streamline, Streamline, Streamline: Eliminate unnecessary steps, automate repetitive tasks, and offer self-service options wherever possible.

- Empower Your Team: Give your customer service rockstars the knowledge and authority they need to resolve issues quickly and effectively.

- Build a Knowledge Base: Create a comprehensive FAQ section or knowledge base where customers can find answers to common questions on their own.

- Listen to Your Customers: Regularly collect and analyze feedback to identify pain points and areas where you can reduce effort.

- Continuous Improvement: Train your staff on the latest product updates and best practices to ensure they're equipped to deliver effortless experiences every time.

Remember, every interaction is an opportunity to make a customer's life easier. By focusing on reducing effort, you're not just improving satisfaction; you're creating a brand that people love to do business with.

#9 - Renewal Rate: The Relationship Litmus Test for Your Business

Your renewal rate is like a relationship litmus test for your business. It tells you how many of your customers are truly committed to sticking around for the long haul. Think of it as a measure of your brand's relationship status: "It's complicated," "single and ready to mingle," or "happily ever after."

Here's why your renewal rate is the relationship guru you never knew you needed:

- Customer Satisfaction Check: A high renewal rate is like a glowing review on your dating profile. It means your customers are happy with your product or service and see real value in your offer. This is typically known as a "customer satisfaction score," another lovely metric.

- Revenue Stability Forecast: Your renewal rate predicts your financial future. A high rate means you can count on a steady income stream, while a low rate might signal stormy financial seas ahead.

- Roadmap to Improvement: By analyzing your renewal patterns, you can identify areas where your product or service needs a little extra love. Customers who don't renew often have valuable feedback that can help you make improvements.

Calculate Your Renewal Rate in 3 Simple Steps

- Count the Renewals: How many customers renewed their subscriptions or contracts during a specific time period?

- Count the Eligible: How many customers were up for renewal then?

- Do the Math: Divide the number of renewals by the number of eligible customers, then multiply by 100 to get your percentage.

Example: If 90 out of 100 customers renewed their subscriptions last month, your renewal rate is a stellar 90%!

How to Boost Your Renewal Rate and Keep the Sparks Flying

- Stay in Touch: Don't ghost your customers. Send regular updates, newsletters, and surveys to keep the conversation flowing.

- Get Personal: Use customer data to personalize your interactions, offers, and recommendations. Show them you know and appreciate them.

- Offer Sweet Treats: Give your customers a reason to renew with exclusive discounts, bonus features, or early access to new products.

- Make Renewing a Breeze: Eliminate any friction in the renewal process. Make it so easy they can renew with a single click.

- Listen and Learn: Actively seek feedback and use it to improve your offerings. Show your customers you value their opinions and are committed to meeting their needs.

Remember, a high renewal rate is the foundation for a thriving business. By nurturing your customer relationships and continuously improving your offerings, you can create a loyal community of fans who will stick with you through thick and thin.

#10 - Product Adoption Rate: Your Growth Engine's RPMs

Think of your product adoption rate as the RPMs of your business's growth engine. The faster it spins, the more horsepower you generate.

A high adoption rate means your product hits the sweet spot with your target audience. They're not just signing up; they're actively using and loving your product. This is a crucial indicator that your product is genuinely solving a problem and providing real value.

Why Your Product Adoption Rate is Your North Star

- Growth on Steroids: A high adoption rate means you're attracting new users and expanding your market share like wildfire. It's a sign that your marketing and sales efforts are paying off.

- Happy Customers = Happy Metrics: When customers adopt your product and use it regularly, it's a clear sign they're finding value in it. This aligns perfectly with your customer success goals.

- Product-Market Fit Validation: Your adoption rate is a reality check for how well your product matches your target audience's needs. A low rate? Time to refine your product or messaging.

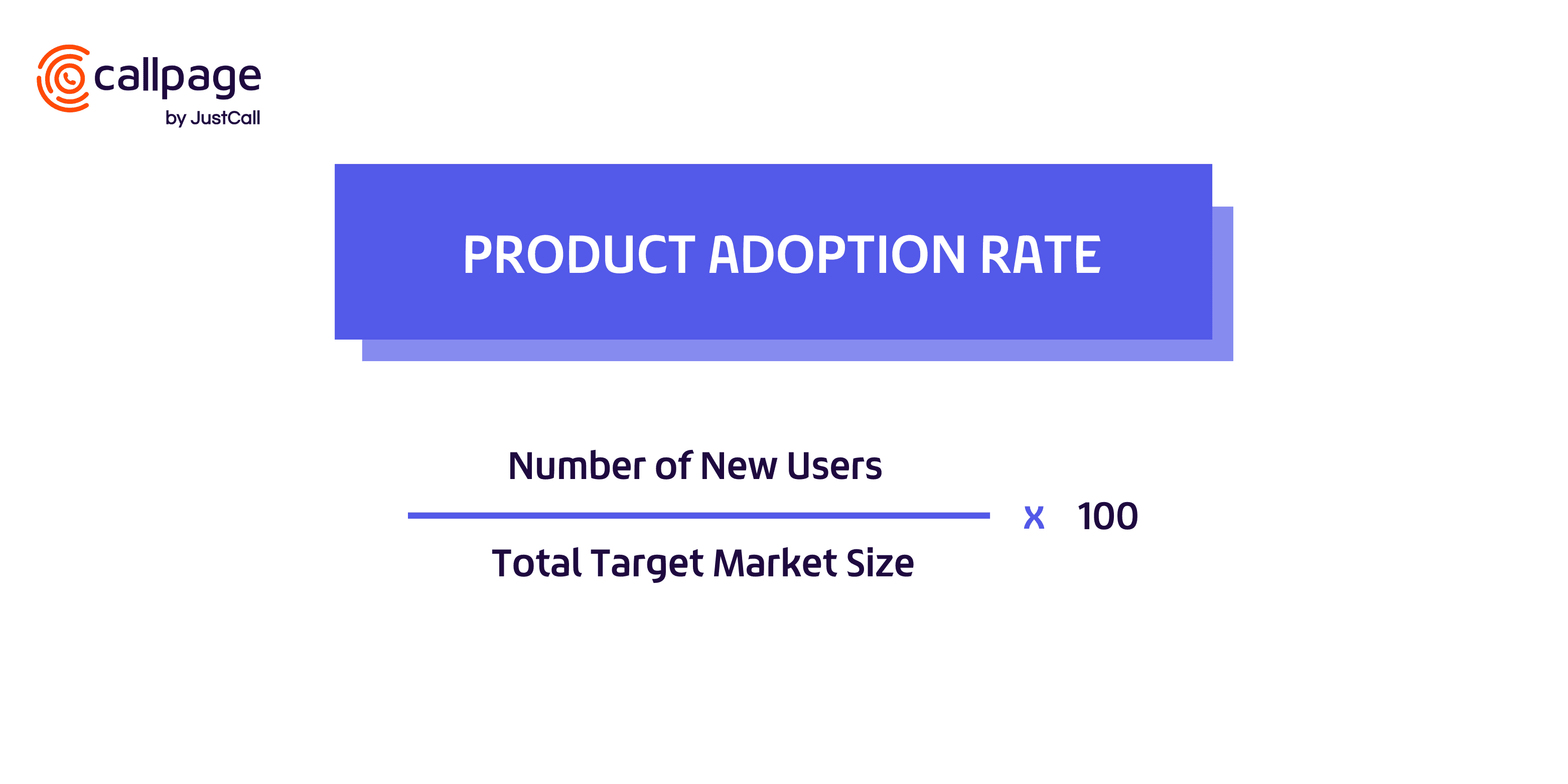

How to Calculate Your Product Adoption Rate

Simple! Just use this formula:

Product Adoption Rate = (Number of New Users / Total Target Market Size) * 100

Example: If you gain 1000 new users this month and your target market is 100,000, your adoption rate is 1%.

Pump Up Your Adoption Rate

Ready to rev up your growth engine? Here's how:

- Educate Your Users: Don't leave them guessing. Create engaging tutorials, webinars, and guides to showcase your product's features and benefits.

- Optimize Onboarding: Make the first experience a smooth one. Offer personalized guidance based on their specific needs and goals.

- Listen and Learn: Gather feedback through surveys, social media, or direct communication. Use this intel to improve your product and make it even more irresistible.

- Build a Community: Create a space for users to connect, share experiences, and learn from each other. This fosters a sense of belonging and encourages continued use.

- Never Stop Improving: Keep refining your product based on user data and market trends. Stay ahead of the curve and keep your customers coming back for more.

Remember, a high product adoption rate is a sign of a product that resonates with its audience. By focusing on education, engagement, and continuous improvement, you can create a product that people love to use and a business that thrives.

Ready to Turn Data into Dollars? Your Action Plan for Customer Success

You've got the knowledge; now it's time to flex your customer success muscles! Here's your no-nonsense action plan for turning those metrics into a marketing machine that'll make your competitors jealous.

Step 1: Choose Your Metrics Wisely

No need to track every single number under the sun. Focus on the metrics that align with your business goals.

- Want to reduce churn? Keep an eye on customer health scores and renewal rates.

- Want to boost customer satisfaction? CSAT and CES are your friends.

- Want to increase revenue? Focus on CLV and MRR.

Step 2: Make Metrics a Habit

Don't let those numbers gather dust on a forgotten spreadsheet. Integrate them into your daily routine.

- Dashboards: Create visual displays of your key metrics so you can track your progress at a glance.

- Regular Reports: Schedule weekly or monthly reports to keep everyone in the loop and identify trends.

- Team Huddles: Discuss your metrics as a team and brainstorm ways to improve.

Step 3: Get Tech-Savvy

There are tons of tools and platforms out there to help you track and analyze your metrics.

- Google Analytics: A free powerhouse for understanding website traffic and user behavior.

- Mixpanel: Perfect for tracking user interactions and product usage patterns.

- Tableau: Create stunning data visualizations that'll make your insights pop.

- HubSpot: A comprehensive CRM with built-in analytics for tracking customer journeys.

Step 4: Become a Data Whisperer

Collecting data is just the first step. Now, it's time to decipher its secrets.

- Spot the Patterns: Look for trends, correlations, and outliers. What's working? What's not? Are there any surprises?

- Consider the Context: Don't just look at the numbers in isolation. Factor in external factors like seasonality, market trends, or even current events that could influence your results.

- Turn Insights into Action: Data is only useful if you use it. Translate your findings into concrete steps you can take to improve your customer experience and drive growth.

By following these steps and making data-driven decisions a habit, you'll transform your business into a customer-centric powerhouse that's unstoppable.

FAQs: Your Burning Questions About Customer Success Metrics, Answered

We know diving into customer success metrics can feel like learning a new language. So, let’s clear up some common questions and make sure you’re speaking fluent customer success in no time.

Which Metrics Should I Be Tracking?

There’s no one-size-fits-all answer, but here are some MVPs (Most Valuable Player metrics) to consider:

- Customer Satisfaction Score (CSAT): The “How happy are you?” gauge.

- Net Promoter Score (NPS): The “Would you recommend us?” test.

- Customer Effort Score (CES): The “How easy was it to do business with us?” meter.

- Churn Rate: The “How many customers are leaving?” reality check.

- Customer Lifetime Value (CLV): The “How much money will this customer bring us?” predictor.

The specific metrics you choose will depend on your business goals and what keeps you up at night.

How Often Should I Check My Metrics?

It depends on the metric and your business rhythm, but here’s a general rule of thumb:

- Real-Time Monitoring: For things like website traffic or support interactions, real-time is the way to go. You can quickly spot and address issues.

- Weekly/Bi-Weekly: Check in on NPS scores, support ticket trends, and engagement metrics every week or two to track progress and catch any red flags early on.

- Monthly Deep Dive: Once a month, do a comprehensive review of all your key metrics to get a holistic view of your customer success performance.

Can I Improve Customer Success Without Hiring a Whole New Team?

Absolutely! You don’t need a massive budget to make a big impact. Here are a few tips:

- Automate, Automate, Automate: Use technology to handle repetitive tasks like sending follow-up emails or providing basic support.

- Empower Self-Service: Create a killer knowledge base or FAQ section so customers can find answers independently.

- Invest in Training: Give your existing team the skills and tools they need to be customer success superheroes.

What’s the Difference Between Customer Success and Customer Service Metrics?

Think of it like this:

- Customer Success: The big picture. Are your customers achieving their goals? Are they loyal to your brand?

- Customer Service: The individual interactions. Were their issues resolved quickly? Are they satisfied with the support they received?

Both are important, but they have different focuses.

How Do I Know if My Customer Success Strategy Is Working?

Look for these signs of success:

- Higher Retention Rates: Your customers are sticking around longer.

- Skyrocketing NPS Scores: More and more customers are singing your praises.

- Positive Feedback Galore: Customers are raving about your product or service.

- Increased Product Usage: People are using your product more often and getting more value out of it.

By tracking these indicators, you’ll have a clear picture of how your strategy is performing and can make adjustments as needed to keep those customers happy and coming back for more.

How Does a Customer Success Team Impact Customer Success Metrics?

An effective customer success team focuses on building strong relationships and post-sale activities, which can significantly improve metrics such as customer lifetime value and renewal rates.

Wrapping It Up

Don't let your customer success metrics remain mere numbers on a screen. They are the key to unlocking a future of growth, loyalty, and unparalleled customer satisfaction.

From predicting churn to skyrocketing CLV, these insights are your roadmap to a thriving business.

Your customers are waiting. Take the leap today and unlock a new level of customer-centric success.

Check out other posts

Start generating leads today!

Start a 14-day free trial now,

set up the widget on your site, and see how many more leads you can capture with CallPage

- No credit card required

- 10 minutes set up

- 14 days fully-features free trial